Introduction:

When you’re considering life insurance, most people focus on the policy details: premiums, coverage amounts, and terms. But there’s another crucial factor you might not have considered—can the insurance company actually pay when the time comes? That’s where the solvency ratio steps in. It measures an insurer’s financial health and ability to fulfill its promises.

If you’ve ever wondered how to assess an insurance company’s ability to cover claims, understanding the solvency ratio is essential. This guide will help you understand What is a Solvency Ratio in Life Insurance?, how it works, and why it’s so important when choosing a life insurance provider.

What is a Solvency Ratio or Solvency Capital, and How is it Calculated?

Simply put, a solvency ratio measures an insurance company’s ability to meet its long-term debt and claims obligations. It shows whether the insurer has enough financial resources to stay afloat and pay policyholders when needed.

Here’s how the formula works:

Solvency Ratio= Available Capital / Required Capital

Think of available capital as the company’s financial cushion—its assets minus liabilities. Required capital, on the other hand, is the amount set by regulators, that ensures the insurer has a sufficient buffer for unexpected losses. The solvency ratio compares these two numbers to give you an idea of whether the company is financially secure.

A ratio over 100% means the insurer is in good shape, while a lower number suggests it might struggle to pay out claims in tough times. In India, life insurance companies are required by the IRDAI to maintain a minimum solvency ratio of 150%, meaning they should have 1.5 times the capital they are expected to need.

How is Solvency Capital Calculated?

To calculate solvency capital, insurance companies consider several factors. These include the risks they take on by insuring customers, the types of investments they hold, and their overall business model. The goal is to ensure that even in the worst-case scenario—whether it’s a market downturn or a surge in claims—the company can still meet its obligations.

Essentially, the solvency ratio gives you peace of mind. It tells you whether the insurer can back up the promises it makes, even during challenging times.

Types of Solvency Ratios

Solvency ratios come in different forms, offering a broader view of a company’s financial strength. Let’s look at a few key types.

Solvency Margin

The solvency margin is the buffer between the insurer’s assets and liabilities. It’s the extra cushion that helps the company handle financial stress. A healthy solvency margin indicates that the insurer can meet unexpected claims or deal with economic fluctuations.

In life insurance, this margin is critical because policies last for decades, and the insurer needs to be able to pay out claims at any time.

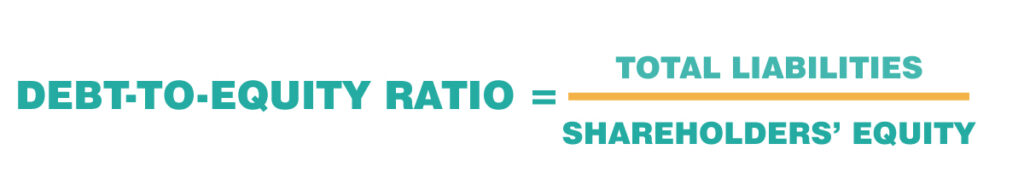

Debt-to-Equity Ratio

The debt-to-equity ratio shows how much of the company’s operations are funded by debt compared to shareholder equity. A lower ratio generally means the insurer isn’t overly reliant on borrowing, which is a good sign of financial health. Insurers with a high debt-to-equity ratio might be more vulnerable during financial downturns, which could impact their ability to pay claims.

Debt-to-Equity Ratio=Total Liabilities/Shareholders’ Equity

A lower ratio means the insurer relies more on its own capital rather than debt, making it more stable.

Solvency Ratio vs. Liquidity Ratio: What’s the Difference?

While both solvency and liquidity ratios assess a company’s financial health, they focus on different aspects.

Solvency Ratio: Long-Term Health

The solvency ratio focuses on whether the company can meet long-term obligations. For life insurance, where policies can last decades, the solvency ratio is crucial. It tells you if the company will be around to pay out claims when your family needs them most.

Liquidity Ratio: Short-Term Readiness

The liquidity ratio, on the other hand, measures the insurer’s ability to cover short-term liabilities, like immediate claims or operational expenses. It focuses more on day-to-day financial health. A company with a strong liquidity ratio can pay out claims quickly without needing to liquidate long-term assets.

Both are important, but the solvency ratio is the one to watch closely when choosing a life insurance company. Life insurance is a long-term commitment, and you need to be sure the insurer can meet its obligations down the road.

Examples of Solvency Ratios

Let’s look at two key solvency ratios that can help you understand an insurance company’s financial strength.

Debt-to-Equity Ratio

As we covered earlier, this ratio compares the insurer’s total debt to its equity. A lower debt-to-equity ratio indicates that the insurer isn’t overly dependent on borrowing to finance its operations, reducing the risk of financial trouble.

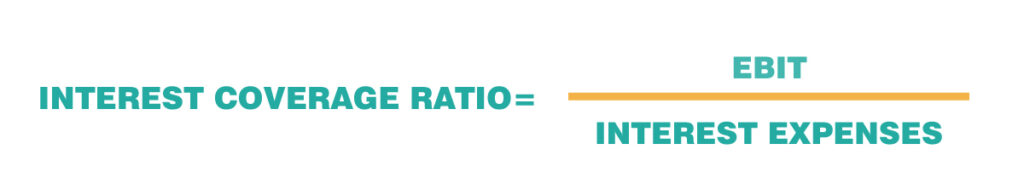

Interest Coverage Ratio

The interest coverage ratio shows how easily a company can pay the interest on its debt. A high ratio indicates that the insurer generates enough earnings to comfortably cover its interest payments, which is a good sign of financial health.

Interest Coverage Ratio=EBIT / Interest Expenses

If the ratio is low, the insurer might struggle to meet its debt obligations, which could put its ability to pay claims at risk.

Why is Checking the Solvency Ratio Important in Insurance?

The solvency ratio matters because it directly impacts whether the company can honor its financial commitments. Buying life insurance is a long-term decision. You’re investing in a policy that may last 20, 30, or even 40 years. During that time, you need to be sure the insurer can stay financially stable and payout when needed.

A strong solvency ratio gives you confidence that the insurer will be able to cover claims, even during economic downturns or if unexpected financial challenges arise. On the flip side, an insurer with a weak solvency ratio could struggle to meet its obligations, putting your policy—and your family’s financial security—at risk.

Does the Solvency Ratio Matter When Buying Insurance Plans?

Yes, it absolutely does. When comparing life insurance options, don’t just focus on the premiums and policy features. The insurer’s financial health is just as important, and the solvency ratio is one of the best indicators of that.

If you choose an insurer with a low solvency ratio, you might face risks down the road. Even if their premiums are lower, the potential for financial instability could leave your beneficiaries without the support they need when it matters most.

Conclusion

The solvency ratio is a crucial measure of an insurance company’s financial strength. It helps you assess whether the insurer can meet its long-term obligations, including paying out claims when needed. By choosing a life insurance company with a strong solvency ratio, you can ensure that your policy—and your family’s financial future—is protected.

When you’re shopping for life insurance, don’t just look at the premiums. Make sure the company is financially stable and has the ability to pay out claims when the time comes. A strong solvency ratio is the key to knowing that your loved ones will be taken care of, no matter what happens.