Ever stare at your bank account after a surprise expense, feeling like you’ve entered a financial twilight zone? Car trouble? Medical bills? Fear not! Some life insurance plans (think whole or universal life) act like piggy banks, building cash value. This means you might borrow from your policy!

It’s like borrowing from your future self, skipping the credit check hassle. Sounds tempting, right? But hold on! Borrowing affects the payout to loved ones. Are there better options?

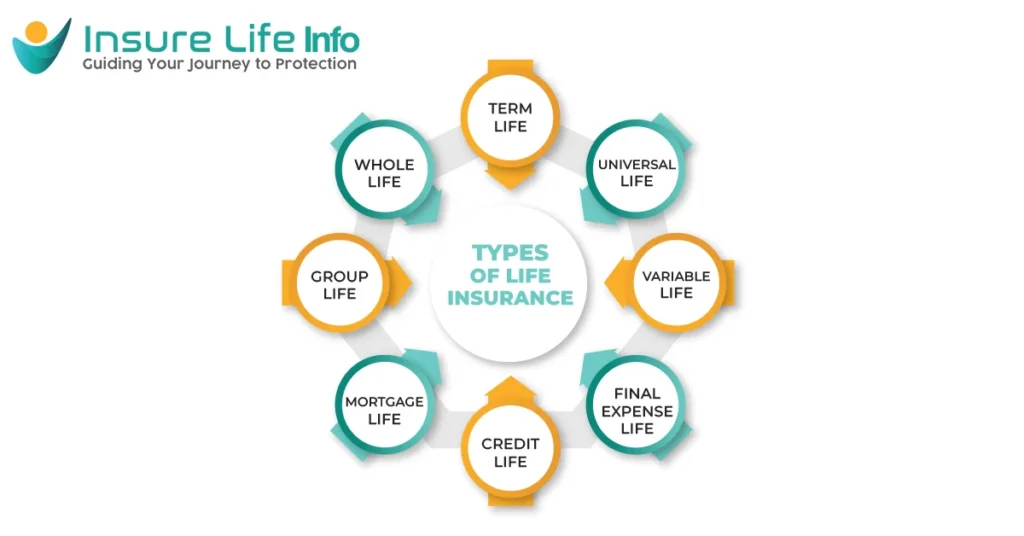

This post will cover life insurance loans, including types, pros, cons, and alternatives.

Table of Contents

What is a Life Insurance Policy Loan?

A life insurance policy loan refers to any money borrowed against the cash value in either a permanent (whole life, universal life, or variable universal life) or variable universal life policy. Your policy’s rules set your loan amount and interest rate; typically less than what’s found with traditional personal or home equity loans and often tax deductible making borrowing against it an easy way of raising capital quickly for major purchases such as second home purchases, college tuition funds for your children or starting your business ventures!

However, you must understand how borrowing against your policy works and whether or not it makes sense for you in your current circumstances. A licensed life insurance representative can assist by providing an “in-force illustration” demonstrating how a policy loan would alter your death benefit.

Types of Life Insurance Policies That Offer Loans

Most whole and universal life policies with cash values offer the option to borrow against that cash value. Each insurer’s policy loan rules vary in terms of when, how much, and at what speed a policy loan may be taken out.

Not all life insurance policies offer cash value. Most whole and universal life policies with cash values provide an option to borrow against that cash value. You can find more information about the differences between Term Life and Universal Life Insurance. When borrowing, your insurer lends you money using your policy as collateral meaning no funds can be withdrawn, nor will the death benefit decrease as a result of borrowing against your cash value.

Loaning out your policy has many advantages, including no credit checks and competitive interest rates; flexible use of funds; and no restrictions on who can borrow the funds. But before making your decision, be aware of all of its ramifications; failing to repay in full may reduce your death benefit and could even jeopardize its future growth.

How to Borrow Against Your Life Insurance Policy

Permanent life insurance policies typically build cash value over time, and many allow policyholders to borrow against it through policy loans. Funded by insurance companies using your policy’s cash value as collateral, policy loans generally do not negatively affect your credit score and offer more flexible repayment plans than bank loans or credit cards. Keep in mind, however, that failure to repay could reduce your death benefit and cause the policy to lapse if payments are missed something credit cards or bank loans would do.

Are policyholders eligible to use this feature? That depends on several factors, such as their type of life insurance policy and the amount of time necessary to accumulate enough cash value for borrowing. Furthermore, any excess earnings on top of your cost basis constitute taxable income and it’s therefore crucial that they create a detailed repayment plan and monitor any increases or decreases in their interest rates closely.

Benefits of Borrowing Against Your Life Insurance Policy

Policy loans typically do not require a credit check and can be processed quickly. Furthermore, they will not adversely impact your insurance rating and do not impact credit bureaus in any way.

However, it’s essential to remember that loan interest will continue accruing until your loan balance has been paid in full. If the outstanding loan balance exceeds your policy’s cash value threshold, your policy could lapse and leave your beneficiaries with reduced death benefits.

Consider all your funding sources carefully when making decisions regarding insurance loans. Do your research on current interest rates charged on personal loans as well as how prevailing market conditions might alter over time and impact your ability to repay policy loans. A financial or insurance professional can assist in balancing immediate needs against future implications such as loan interest accumulation or reduced death benefits.

Risks and Consequences of Policy Loans

Policy loans may offer an economical alternative to using credit cards or taking out personal loans for major expenses. But it’s essential to be aware of all possible risks and repercussions before embarking on such a path. A loan balance plus interest could eventually exceed your life insurance policy’s cash value, leading to surrender or cancellation, with subsequent tax consequences for its proceeds.

One potential risk in taking out a loan is repaying its balance and accrued interest on time; otherwise, your beneficiaries could forego receiving any death benefits as promised by you.

Policy loans will lower your life insurance coverage until the loan balance is paid back, potentially leaving your loved ones with less money than expected from their death benefit payout. Before considering taking out such a loan, make sure that you consult with financial and tax professionals on what the potential repercussions might be.

Understanding Interest Rates and Fees Associated with Policy Loans

As with any loan, policy loans must be paid back with interest added to the outstanding balance. If you fail to do so, your insurance provider may deduct what is owed from your death benefit and reduce payouts accordingly.

Permanent life insurance policies like Whole and Universal Life provide you with access to their cash value, making loans against it possible. Unfortunately, term life does not accumulate cash value and thus cannot be borrowed against.

As soon as your life insurance policy has accumulated enough cash value in its account, borrowing from it may begin. Unlike with traditional loans or credit card rates, no credit check or qualifying requirements need to be submitted when borrowing against it – plus its interest rate tends to be much lower!

Alternatives to Borrowing Against Your Life Insurance Policy

Borrowing against your life insurance policy offers a quick source of cash without needing to undergo credit checks, yet you must understand its potential repercussions. Failure to repay could reduce or cause a lapse of the policy resulting in reduced death benefits or payout to beneficiaries. In addition, if your outstanding loan balance plus interest exceeds its cash value then income taxes may apply as a result of paying income taxes due.

If you need immediate funds and have a good standing with your insurance provider, a policy loan could be the solution for you. But other options may be more appropriate; viatical settlements offer lump sum payouts in exchange for existing life policies without needing a credit check and often come with lower rates than personal or home equity loans.

While policy loans offer a quick source of cash without credit checks, it’s crucial to understand their potential downsides. Here’s a comparison of Policy Loans with other borrowing options:

Comparison of Borrowing Options

| Feature | Policy Loan | Personal Loan | HELOC |

|---|---|---|---|

| Collateral | Life Insurance Cash Value | None | Home Equity |

| Credit Check | No | Yes | Yes |

| Interest Rate | Competitive, typically lower than personal loans | Varies depending on creditworthiness | Varies depending on creditworthiness & loan-to-value ratio (LTV) |

| Access to Funds | Relatively quick &easy | May take a few days to receive funds | May take a few weeks to receive funds |

Conclusion:

By understanding the intricacies of policy loans, you can make informed decisions about leveraging your life insurance policy’s cash value. Remember to weigh the benefits against the potential risks and consider alternative options. With careful planning and expert guidance, you can unlock the potential of your policy and secure a brighter financial future for yourself and your loved ones.

Read More About Life Insurance

FAQ’s:

Can I borrow against my life insurance policy?

Yes, most whole and universal life policies allow borrowing against their cash value. However, the loan balance and interest may reduce your death benefit.

How do policy loans work?

Policy loans use your policy’s cash value as collateral, offering competitive interest rates and flexible repayment terms. Repayment is typically made from policy dividends or premium payments.

What are the benefits of policy loans?

Policy loans offer quick access to cash without credit checks, lower interest rates than traditional loans, and flexible repayment plans. They also don’t impact your credit score.

Are there risks associated with policy loans?

Yes, failing to repay the loan can reduce your death benefit, and outstanding loan balances may accrue interest. Missed payments can also cause the policy to lapse.

Can I borrow from my term life insurance policy?

No, term life policies don’t accumulate cash value, making borrowing against them impossible. Only permanent life insurance policies like Whole and Universal Life offer this feature.

Should I consider alternatives to policy loans?

Yes, options like virtual settlements or personal loans may offer better terms or lower interest rates. It’s essential to consult with a financial advisor to determine the best option for your situation.